Since the beginning of May everyone in the Housing Market sector has been anxiously following the steep rising of mortgage rates. What exactly happened – at the beginning of May the fixed rate for 30 years was 3.59% and at the beginning of September the same rate reached 4.73%. In other words, according to MBA, if we take a mortgage of $200,000, the monthly payment on it has increased with 15%. There are concerns that this rising will freeze the Housing Market, but research shows the case is quite different.

Increase of the impact of sustained rate in the long run

The statistics show that although the higher mortgage rates impact both the spikes and refinancing, the periods since year 1999 with higher mortgage rates were marked with more applications for mortgage purchasing, more NAR existing and pending sales of homes and more Census sales of new homes. In other words, despite the high mortgage rates, the House Market has been blooming, except for the refinancing applications.

And here’s the secret behind that phenomenon – the statistics show that the higher mortgage rates are in periods when there is better and more stable economy. This is derived from the relationship between the unemployment rate and the 30 years fixed rate since 1999 – -0.8. So there is no surprise in the fact that every indicator related to the Housing Market showed increased activity (except for, as mentioned above, refinancing), when there was stronger economy. In other words, we can say that stronger economy means more – more sales, more applications for home-purchasing mortgage, higher prices of the homes and higher mortgage rates.

The relation between mortgage rates and housing price

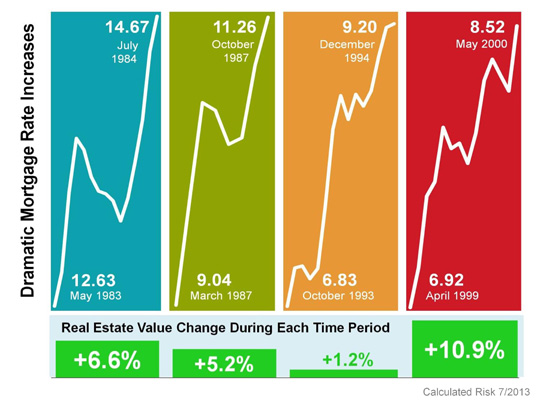

For everyone who is in the Housing Market business, it is obvious that the prices of houses are correlated to the mortgage rates. There is a simple explanation for this – the payments. As the majority of people need to finance their homes, they decide the future of their homes depending on the monthly payments or, in other words, what is affordable for them. Obviously, the growth of mortgage rates leads to a growth in the price of houses, except in some special periods when the housing prices depend on other factors.

The impact of rising mortgage rates

The problem with mortgage rates is that we cannot count only on them to carry out a Housing Market analysis. Even if they are constantly growing, there are other factors that influence the housing prices – the stabilization of economy, the looser mortgage credit and the expansion of inventory.

The first one – the stabilization of economy, impacts and accompanies the rising of mortgage rates. The stronger the economy – the higher the rates. Additionally, there are two reasons for loosening of the mortgage credit – the more the diminishing of refinancing applications, the higher the rate of home-purchase lending; and there are new mortgage rules coming soon, which may make the banks design safer mortgages and thus reduce their rising. And, when it comes to inventory, that is quite a contradictory indicator, because it may either help mortgage rates in slowing down the sales, or it may actually increase the sales as there are more homes on offer.

To cut a long story short, understanding the housing market is quite a hard thing to do, as it is directly correlated to economy. In other words, we can see the immediate impact of rising mortgages, but we cannot predict how it will affect the housing market in the future – mortgage rates are only one of the factors that specialists consider when analyzing the housing market, so let’s hope that they won’t affect the sales of homes too much and will soon drop again for the best.